Reconciliation has always been a headache for finance teams.

The process is time-consuming, manual and error-prone and unfortunately, there’s no escaping it. It is essential to track your expected payments and bills for effective cash flow management and planning - working out which vendor you need to pay and when.

At Payable we believe in process automation and helping finance teams spend time on work that truly matters. That is why our Reconciliation product now also automates Accounts Payable (A/P) reconciliation, tracks bills owed per supplier and gives you more control of your cash outflows.

We automate the entire A/P reconciliation process, seamlessly writing your reconciled bank transactions into your ERP or accounting system, saving you and your team hours (even days!) each time you close your books.

Let’s dive into the features and benefits of A/P Reconciliation.

Save time with automated workflows

Track your committed spend in real time

With Payable, you can now have a single view of your vendors and bills. It gives you a snapshot of your cash outflows and helps you manage your budget seamlessly.

Simply connect your ERP or accounting software with Payable and we will automatically bring all your vendors and bills into our platform, to start reconciling them against your bank transactions. Payable captures all the details of your bill payment, so you can see when it's due, how much tax is owed and what chart of accounts the line items relate to.

Automate your reconciliation process from start to end

This is where the magic happens. Our powerful reconciliation engine will automatically reconcile payment against your bank feed once the bill is paid. With machine-learning technology built in, the engine learns names and references from previous matches making your process better, faster and more accurate each time. Did we mention our reconciliation match rate is over 95% and it keeps getting better? That’s right.

Keep track of your spend per vendor

Want to know how much you have paid each vendor? In your vendor account, you can track all the bills, transactions and information associated with your supplier giving you clear visibility of your payment history and expected payments.

Audit trail for compliant workflows

A clear audit trail is important to keep your books compliant and evidenced. Payable will show which bill corresponds to which bank statement so you have a clear audit trail of what was paid and when.

Why should I care?

So what’s the potential behind the automated A/P reconciliation process?

- Time savings: As you know, reconciliation is a time and resource vampire. Think hours (even days!) each time you need to balance the books. Payable automates the process from start to end connecting all your bank feeds, payment sources with bill payments and vendor records from your ERP or accounting tool.

- Accurate records: Manual processes lead to errors and that is the nemesis of finance teams. Eliminating manual data entry keeps balances in check and up to date. Payable will automatically update your ERP and accounting tools each time the bill payment is reconciled. Reduce your financial errors, avoid penalties and lost revenue.

- Happy suppliers: Business relationships are delicate and missing a bill payment is a surefire way to erode them. With Payable you get a clear view of your upcoming bills and when they are due. Retain your trust with suppliers and pay your bills on time, every time.

- Cash control: Payable gives real-time visibility on your upcoming bills and vendors giving you control of your cash outflow and putting you in the driving seat of managing liquidity in the most optimal way.

Automate your A/P reconciliation with Payable

Imagine a world where you never again have to manually input a transaction or waste time searching through bank statements. Streamlining your A/P reconciliation process will save hours (even days) each time you close your books.

Payable automates the entire A/P reconciliation process from start to end. With direct bank connectivity and ERP and accounting integrations, you will never have to worry about manual data entry and lost payments. And our intelligent reconciliation engine will only make your reconciliation process hands-free while our clever automations handle the complexity and manual work for you.

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

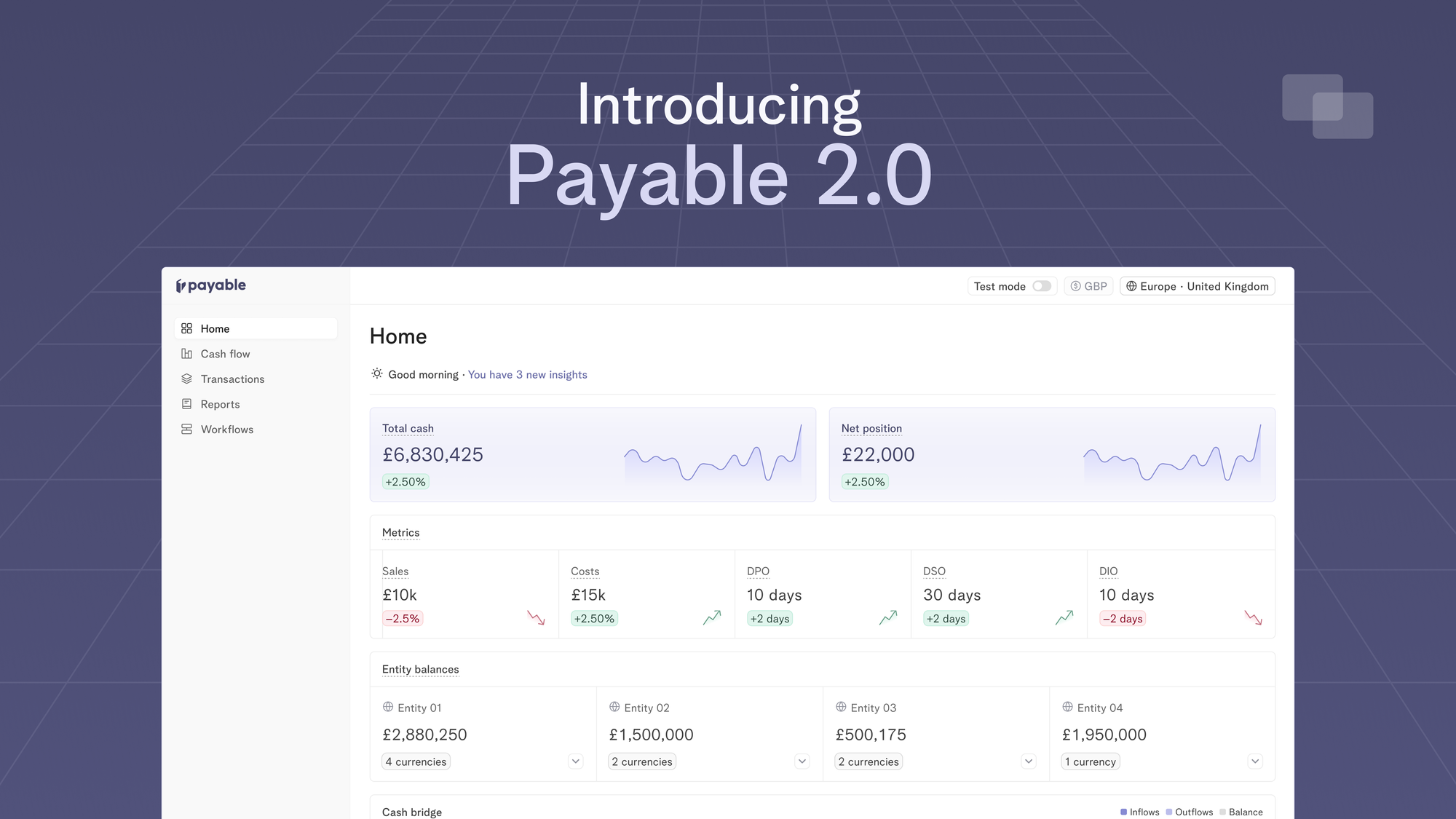

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.