Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure.

The Fintech Trifecta: Cheaper, Faster, Simpler

Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's cheaper stock trading, easier identity verification, faster customer payments, Airbnb facilitating stays or Sainsbury's selling groceries, businesses need to receive money efficiently. It all circles back to money movement.

But here's the catch: moving money isn't just about simple transfers — it has significant upstream and downstream impacts on organisational processes, particularly accounting from customer withdrawals to invoice reconciliation, and from the acquirer to the merchants or suppliers.

The dance between money movement and accounting presents a complex and fascinating problem that requires automation.

Financial Automation: A Stagehand

Think of a business as a Broadway production. Today, the CFOs and leadership teams are the lead actors driving business strategy. The rest of the finance team are 'stagehands' caught up in financial processes, relying on manual tools like spreadsheets and VLOOKUP functions to manage the backstage operations.

At Payable, we help customers like Lendable and OysterHR keep their ERP systems up to date and reconciled. Financial teams set up rules, and our automation connects the dots between bank transactions, the general ledger, and invoices. Financial processes will become seamlessly automated, regardless of turnover or the volume of invoices.

I firmly believe that the world is becoming more transactional. We are witnessing an explosion in payment transaction volumes as commerce becomes real-time and payments become increasingly embedded and invisible. The future of finance automation is closely tied to Payment Service Providers (PSPs). As payment volumes increase, so does the need for a behind-the-scenes service—an integrator or connector that acts as a stagehand to automate financial processes.

That’s the future we are building.

The Anatomy of Financial Processes

To understand finance automation, we need to break down a business’s financial requirements into three core areas:

- Pay-ins: Incoming Money (Revenue & Deposits)

- Internal Processes

- Pay-Outs: Outgoing Money

Revenue & Deposits:

- Revenue Recognition: When a customer pays money, it’s not just about adding cash to the bank. The business must determine whether the revenue can be recognized immediately or deferred.

- Accounts Receivable: Close the open invoice when payment is received and maintain credit control to follow up on any unpaid invoices for effective cash flow.

- Deposits, Card, Billing & Collections: This involves invoicing, charging, and collecting payments.

Internal Processes

- Tax Implications: Payments are subject to sales tax, VAT, or other taxes depending on the jurisdiction and transaction nature.

- Funds Transfers: Moving money between internal accounts or departments.

- Intercompany transactions: Handling financial transactions between different entities within the organization involves more than just transferring funds; it requires proper documentation and compliance with internal policies and external regulations.

- Budgeting: Allocating and adjusting organization budgets.

- Expense Management: Tracking and approving internal expenses.

- Payroll Processing: Managing employee compensation.

- Reconciliations: Ensuring internal records match external statements

- Audit and Financial Reporting: Preparing internal financial statements and audit reports.

Outgoing Money

- Expense Matching: When money is spent, it needs to be matched with the revenue it helps generate, according to the matching principle in accounting. If you pay in advance for a year’s worth of supplies, you can’t simply deduct all that cost in the month it was paid. Instead, the cost is amortized over the period the supplies are used.

- Accounts Payable: Managing outgoing supplier payments involves more than tracking balances. It’s about timing, reconciliation, ensuring liquidity, and optimizing cash flow.

- Customer Withdrawals: Handling customer requests to withdraw funds.

While we've covered several key areas, the scope of finance processes extends far beyond. In future posts, we'll delve deeper into our learnings at Payable about the evolving role of the CFO's office. Now let's look to the future, several exciting developments are shaping the landscape of finance automation.

The Horizon of Finance Automation

Billing & Subscriptions Orchestration

Stripe, Paddle, Chargebee, and Maxio have an opportunity to enhance their services with an orchestrating experience. These tools automate complex financial operations such as dynamic pricing, tax calculations, and personalized invoicing by incorporating features like Common Expression Language and intuitive workflow UIs.

tax = if location == "EU" then invoiceAmount * 0.20 else invoiceAmount * 0.10Flexibility in revenue models is a challenge in financial operations. Transitioning from a subscription model to a consumption-based model, or expanding to multiple business models, requires dynamic financial adjustments. A robust orchestrating layer addresses this smoothly.

AI-Powered Revenue Recognition

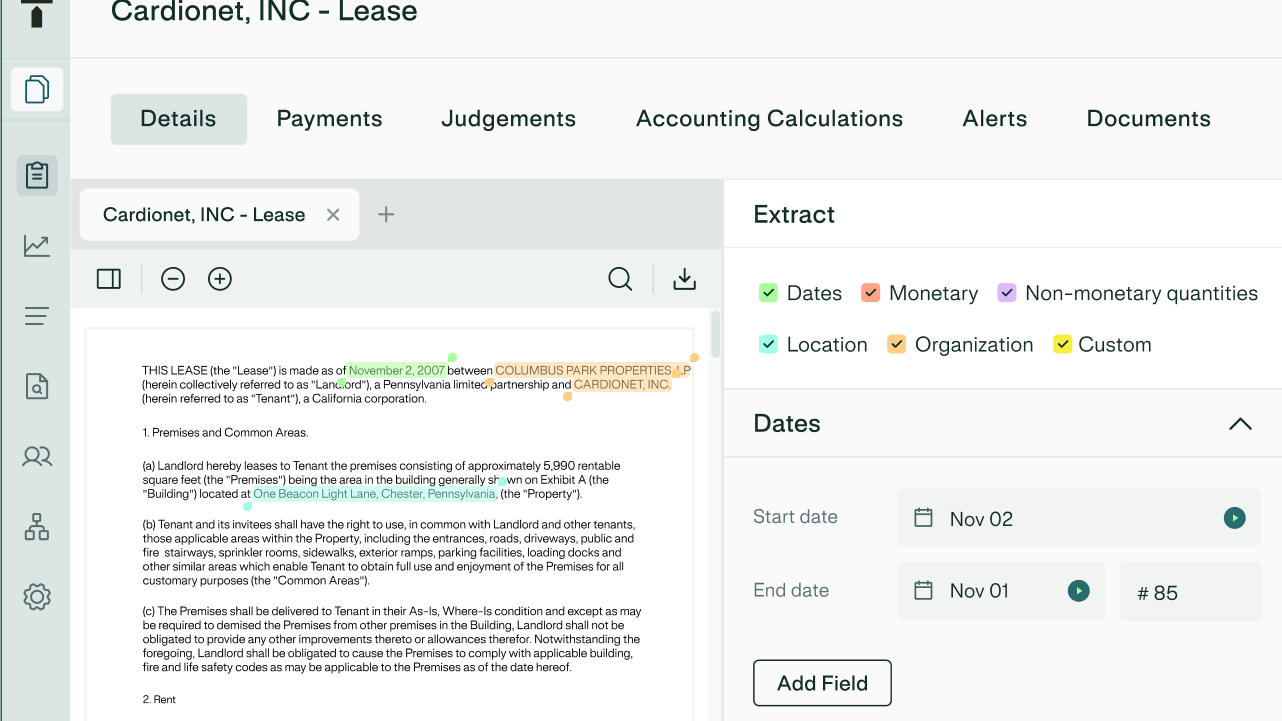

The manual process of reviewing contracts for revenue recognition is ripe for automation. AI assistants can scan contracts, pull customer information from CRMs, and make necessary journal entries are on the horizon. Companies like Trullion are already making strides in this area, focusing on both revenue recognition and lease management.

Payment service providers such as Chargebee, Maxio, and others also support revenue recognition with GAAP standards but without evidence of leveraging AI yet.

AI Assistants for Accounts Receivables

A team manages tracking customer payments using outdated spreadsheets to track millions of dollars in receivables. This labor-intensive process includes invoicing, payment tracking, and following up on overdue payments.

Advanced Integrations for Financial Insights

The future of finance automation lies in sophisticated integrations that transform raw data into actionable insights. Users will be able to query complex financial data without deep technical skills using natural language interfaces. Predictive analysis and trend forecasting will empower strategic financial decision-making.

We won an award for the best cash forecasting solution, but the challenge is in the quality and access of the data.

Unified Financial Workflows

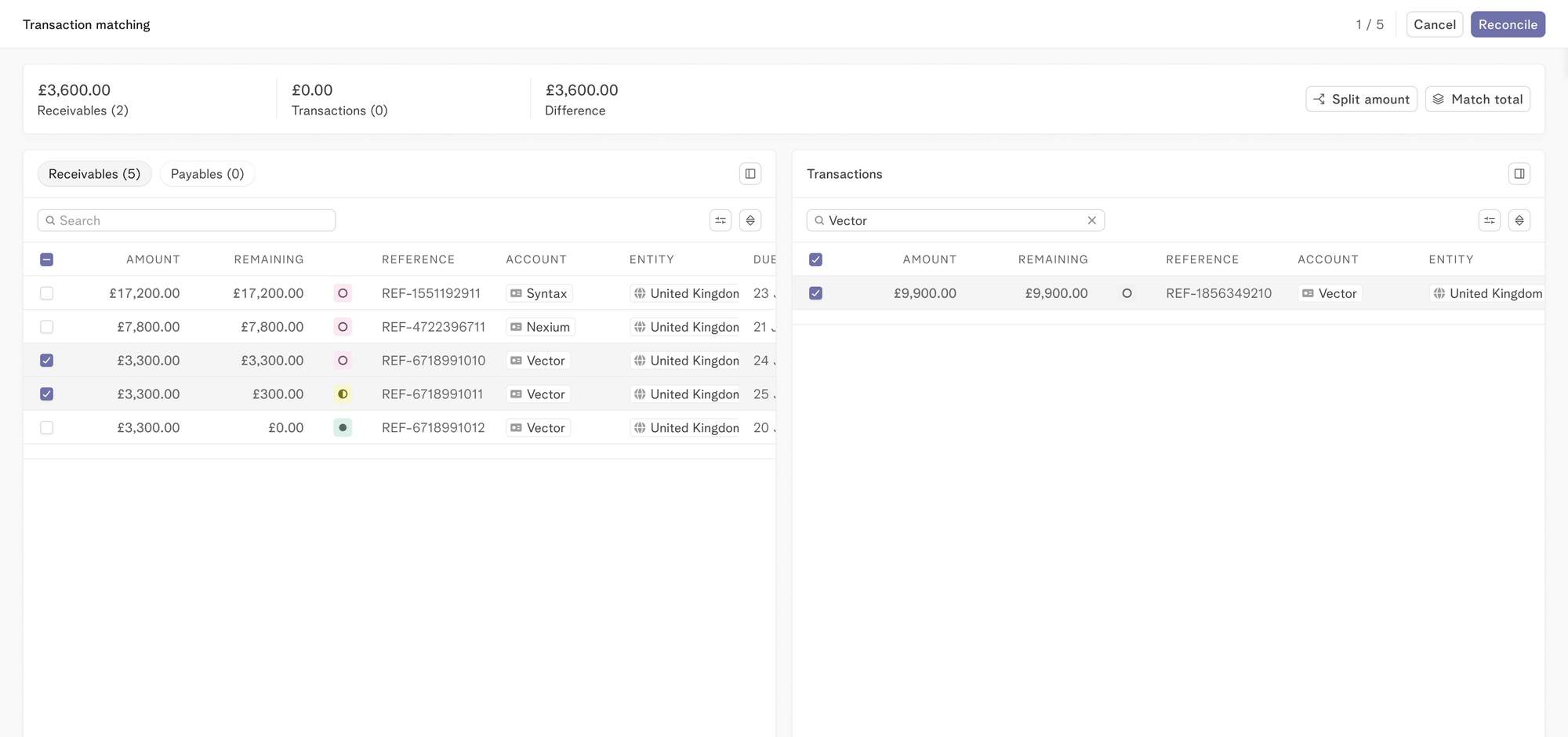

At Payable, we have doubled down on revolutionizing how businesses manage their financial workflows. We provide a no-code environment where financial workflows can be configured completely, streamlining processes for both accounts receivable, accounts payable, and GL reconciliation.

We can achieve an impressive 95% match rate. I envision a future where, with the integration of LLM and AI, there will be an AI assistant that understands the financial context and ensures a 99% reconciliation rate. While the last mile of reconciliation is always the most challenging, AI will bridge that gap, making near-perfect accuracy a reality.

As fintech companies become more accessible, payment rails open up, and AI capabilities advance, we are moving towards a world where most financial processes will be automated. This creates an opportunity in finance automation. It will redefine the role of CFOs, financial controllers and empower businesses of all sizes to operate with unprecedented efficiency.

Daniel

Announcements

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.