Daniel Yubi

Author · 10 articles

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

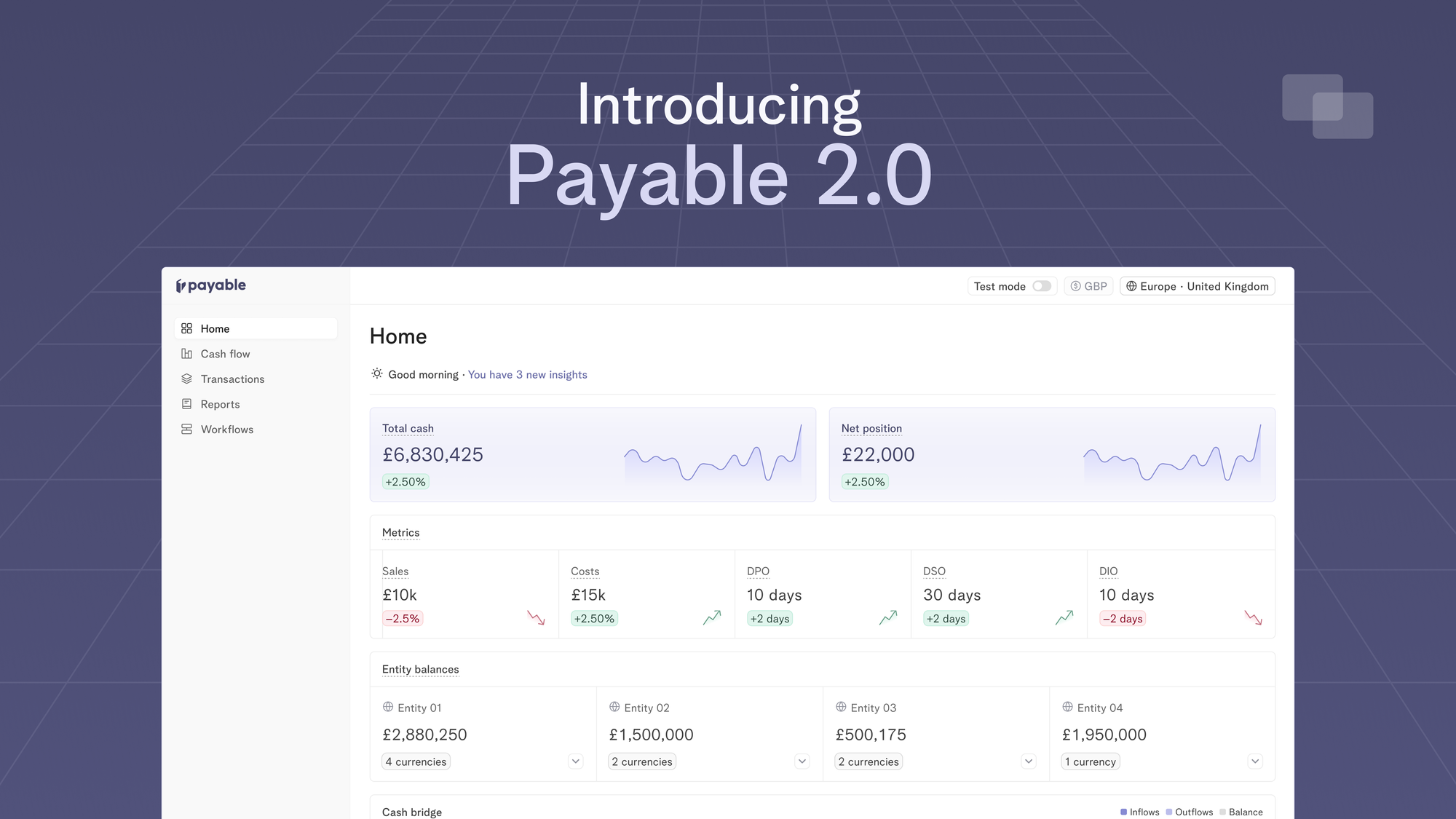

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Announcements

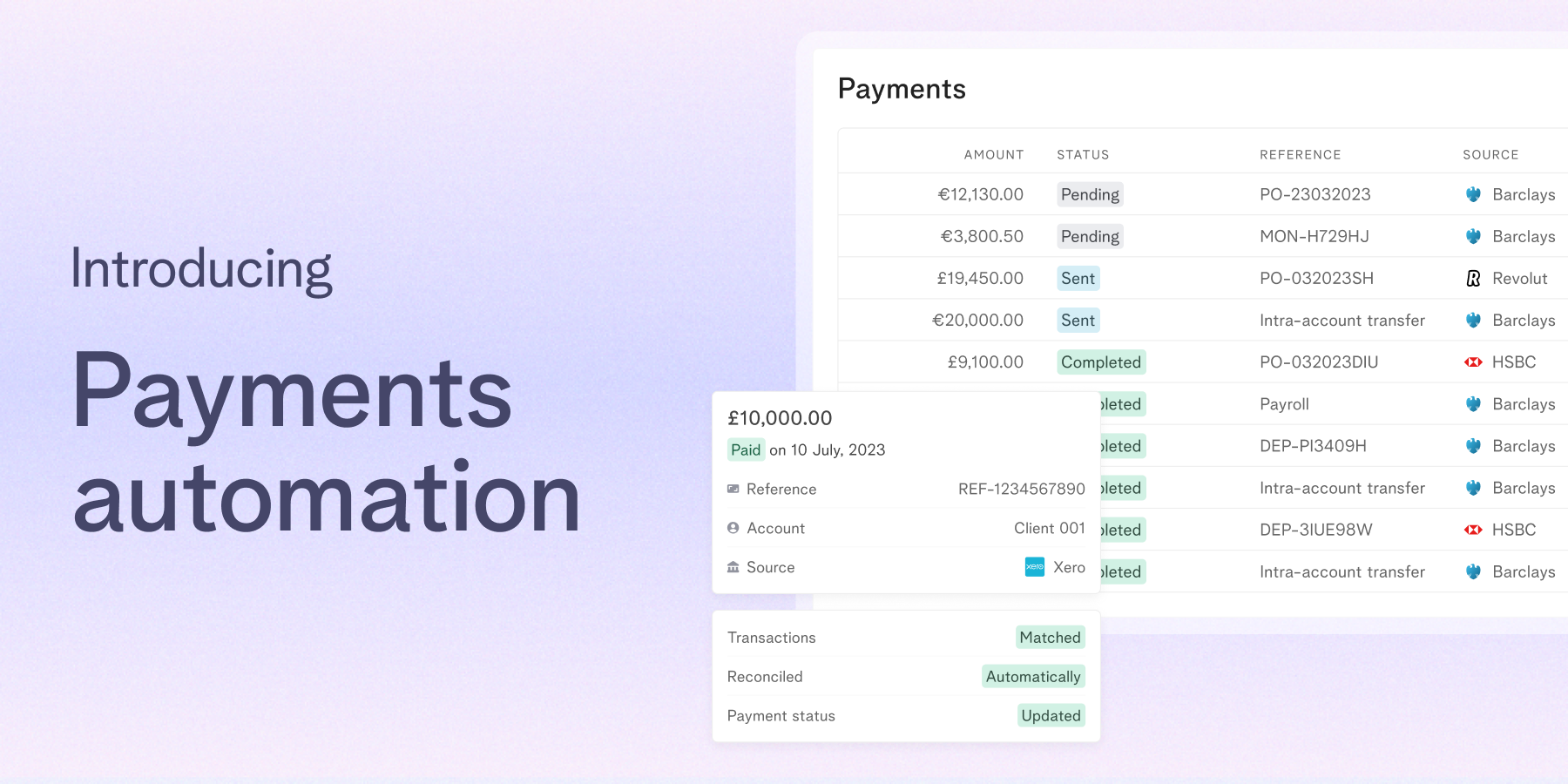

Scale your money movement with clever risk controls

17 Oct 2023

Our Payments automation module automates your payment instructions directly from Payable. We connect with your bank and ERPs so you can easily automate vendor payments without building and maintaining complex integrations.

Team Payable

Our mission to change treasury management

14 Jun 2023

Last month we celebrated our 1st anniversary since launching Payable, which made us reflect on our journey, why we started Payable and what the future holds.

Announcements

Cash visibility with Automated Reconciliation

13 Apr 2023

You can add all your banking partners to Payable and have real-time cash visibility across all your currencies. Instantly know exactly who has paid you what with automated reconciliation. Track all your customer and supplier account balances in real-time.

Payments 101

3 key banking APIs for treasury

13 Mar 2023

In the last post, we explored banking APIs and how bank connectivity is key for a company to successfully scale. As corporate banking customer, there are a few different API types that will 10X your operations as a payments or treasury team. Here we will deep dive into what they are and how they will benefit your business. Payment Initiation API You want to pay your customers, suppliers and users in the most efficient way, but before leveraging a banking API payment operators often depend on

Payments 101

Bank Connectivity - how banking APIs can save you money

28 Feb 2023

Bank connectivity in treasury terms refers to the ability of an organisation to connect and interact with its banking partners. This can include accessing bank account balances and transaction data in real-time, plus initiating and tracking payouts.

Introduction to Payment Operations

15 Feb 2023

Payment Operations is the process of tracking, reconciling, and moving money across your business. Today, this actually happens through spreadsheets, bank files, and legacy protocols like SFTP. 0:00 /2:37 1× When a company reaches a certain level of complexity, payment operations becomes a pain point. The company requires multiple bank accounts and multiple payment providers across different geographies. Let me walk you through why that's happening -

News

We've raised $6.1M to modernise business payments

11 Oct 2022

We've raised $6.1M to build a payment operations platform so companies stop using EBICs, bank files and spreadsheets to move and reconcile money. 💡With Payable, you can connect your banks and automate payments from initiation to reconciliation with a single API and dashboard. About a year ago, Raz and I sat down with the treasury and payment operations team at Checkout.com to understand what it would take us to launch the new marketplace solution. We realised that tech companies depend on cl

Payable: Payment Operations Software

23 Sep 2022

Companies expend huge amounts of effort and money building payment operations. Today, treasury and finance teams have to become quite large to manage their payments. This is not just a problem for traditional organisations - we’ve heard this is happening everywhere from listed companies to start-ups. They are using a tangled web of spreadsheets to track and make payments. That’s insane. Look, there are 8k+ Payment Operations Jobs just in the UK, and 80 added every week. Trillions of dollars t