Payment Operations is the process of tracking, reconciling, and moving money across your business. Today, this actually happens through spreadsheets, bank files, and legacy protocols like SFTP.

What are Payment Operations?

When a company reaches a certain level of complexity, payment operations becomes a pain point. The company requires multiple bank accounts and multiple payment providers across different geographies.

Let me walk you through why that's happening - if you're a company that wants to be in the UK, Germany, and somewhere in the Nordics. First, you need to understand Faster Payment, CHAPs and BACs, so you can send those files to Barclays or any of your banks. If you're in Germany, then you need to understand everything about SEPA, which is Euro payments.

That's because customers want to get paid in their local currency, therefore you need to get a banking partner that supports those types of currencies. If your customers are in Sweden or Norway they want to get paid in the local currency, not in Euros.

The problem

The company will need to find a banking partner to support these currencies and be able to pay out to their customers. This requires having integrations or going to different bank portals to track, send and reconcile money across these different regions.

Germany will require you to send EBIC files, but in the Nordics, you will need Bankgiro and many other rails, which is very painful.

The Solution

How do you solve managing multiple corporate accounts? The options are the following:

- Manual Upload: You can just have a spreadsheet that you upload to your Barclays Filegateway to initiate payments but remember you must validate every bank account or IBAN/Sort Code before uploading the file.

- Semi-Manual: Get an engineer to export a spreadsheet with the customer details, so your Payment Operations team focused on uploading rather than building and validating the spreadsheet.

- Integrate with the bank: You can hire 15 engineers to integrate with different bank accounts and convert those bank files into an API so you have an abstraction layer between your system and your bank account. You will need to maintain those connections and learn about bank files, and certificates plus build an admin tool to reconcile and track funds.

Payable is a plug and play solution to manage your treasury payments, automate bank transfers and manage your cash better 🙌

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

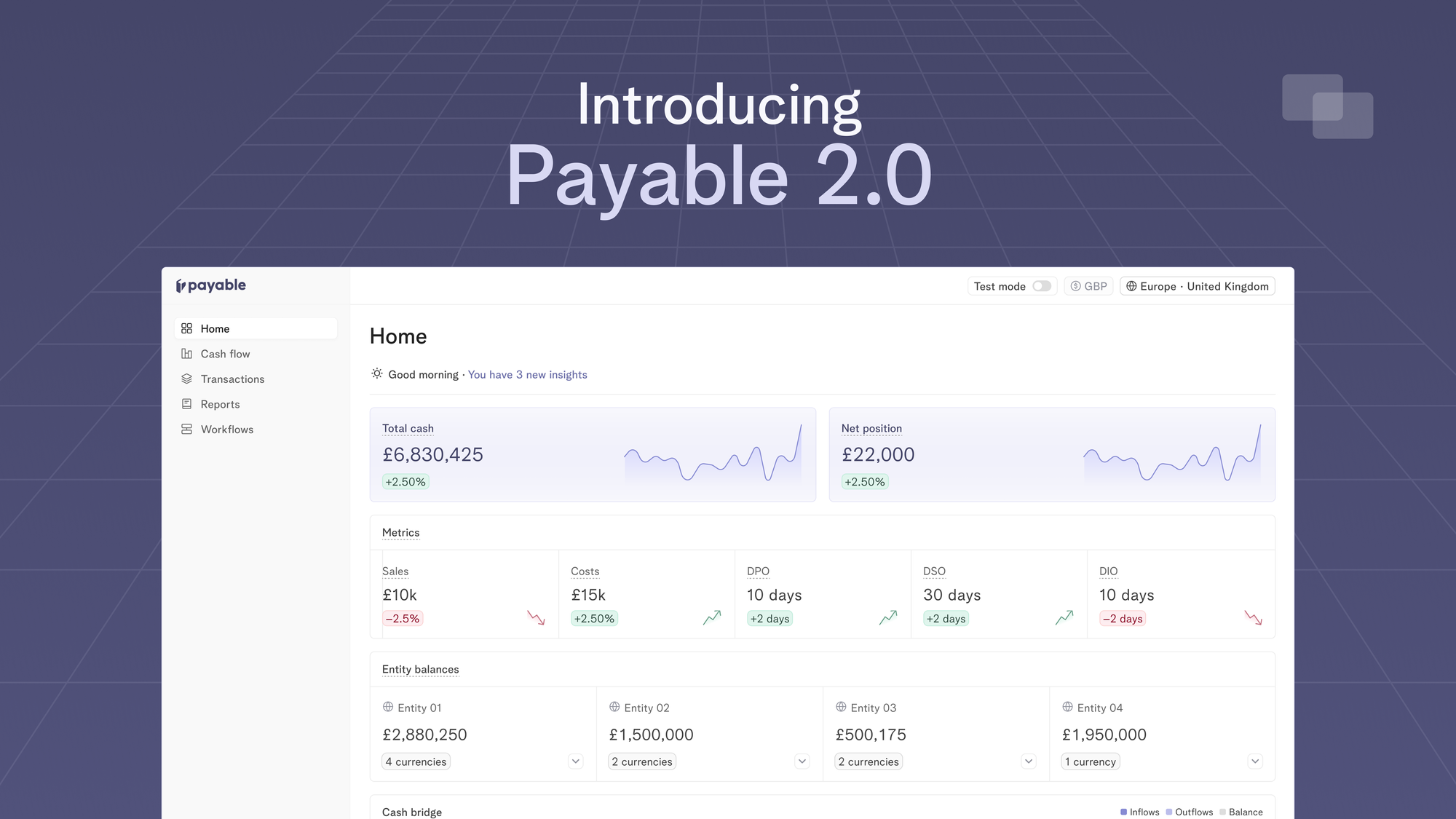

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.