Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash is crucial for every business. However, many finance teams still struggle with manual processes, poor visibility and fragmented data sources when managing cash across multiple locations, entities and currencies. CSV files, manual data formatting and currency conversion is still day-to-day reality for many finance teams.

Payable 2.0 is designed to eliminate tedious tasks and provide a single portal to help you understand:

- Where your cash is - across banks, geographies, entities and currencies

- What your cash is doing - across inflows, outflows, investments, and customer funds

- Where you expect your cash to be in the future

… all in real time.

Payable 2.0 core features

We are introducing four core features as part of today’s launch:

Cash analytics that drive action

Our Analytics dashboard gives insights into your cash flow movements, across entities, currencies, and tags. You can see trends and money movements in your finance reports and drill down at tag or group level to tell your story through accurate insights. Create board updates or weekly cash position reports without ever logging into your bank or copy/pasting data in spreadsheets again.

Learn more

Flexible forecasts done on your terms

Never get caught off guard. Our Forecasting tool guides you step-by-step from setting up bespoke forecasting methods to visualising how these forecasts impact your cash flow in real-time.

We understand that forecasting looks different in every business - some of you keep things lite, while others prefer more advanced models. Which is why we introduce multiple forecasting methods to choose from. They can be applied to specific tags or tag groups, or use advanced forecasting to factor one-off or specific future cash events you know are coming up.

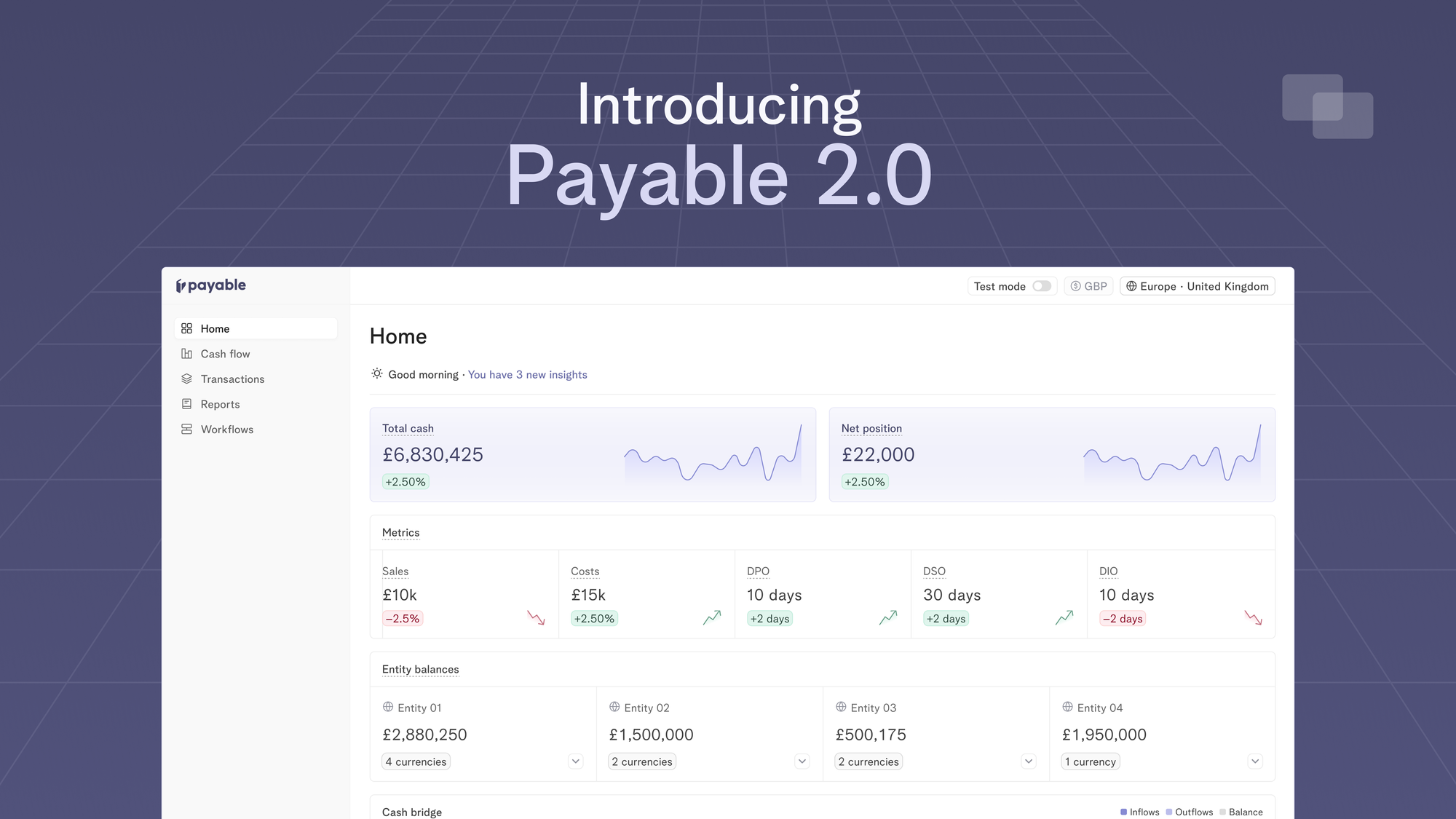

New home for your cash and business metrics

Our new dashboard is redesigned to help you track all your money in one place, even if it's in different accounts, currencies or spread across multiple entities. We connect all your bank accounts and ERP systems to give you real-time visibility into your cash position and your most important business metrics.

The dashboard also includes an overview of your cash inflows and outflows. You can filter and segment by region, entity, currency and more, going from macro to micro view in seconds to investigate cash trends at category, group or even transaction level.

Automated transaction categorisation engine

Cash flow insights are only as good as the tagging and categorisation logic that it's built upon. It’s painstakingly manual and tedious, and every finance person will pull out a fair bit of hair each time they need to investigate whether the Amazon transaction should be attributed to Subscriptions or Office Supplies.

Our intelligent categorisation engine automates all your transactions into logical groupings that fit your reporting needs. And if you need to make changes to any of the grouped transactions, you can edit it on the fly.

Get in touch for a free trial

Huge thanks to our customers and partners that helped us build this iteration of our platform. If you are stuck in CSVs, spreadsheet and bank logins, get in touch today to enjoy a free trial of our platform and see your own finance data and insights come to life.

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.