Companies expend huge amounts of effort and money building payment operations. Today, treasury and finance teams have to become quite large to manage their payments.

This is not just a problem for traditional organisations - we’ve heard this is happening everywhere from listed companies to start-ups. They are using a tangled web of spreadsheets to track and make payments. That’s insane.

Look, there are 8k+ Payment Operations Jobs just in the UK, and 80 added every week.

Trillions of dollars travel through our economy each day, yet companies are making sense of it with outdated products.

That’s why we started Payable.

Finance teams and operations are often neglected when needing engineering time to create tooling and automate their reporting and payments infrastructure. Product teams can't build fintech products to enable new experiences because they need the finance team .

Software for Payment Reconciliation and Moving Money

Instead, complex spreadsheets are spun up and finance operations teams are expanded. Daily downloads of bank transactions are matched with payment providers’ records, or companies just hope for the best when completing their month-end reporting.

The cost and effort of integrating with a TMS or ERP is unnecessarily high for the majority of businesses, but the current solution of completing business-critical transaction reconciliation and cash balancing by long, manual matching processes and a dash of good faith is not okay for modern tech companies today.

No solutions out there cover all the banks, wallets and payment service providers companies are using to run their business. We are here to change that.

We are building a solution that hits the sweet spot. No onerous integrations, real-time data from the providers that matter to you, and it’s easily accessible by anyone in your organisation.

Get in touch to see what we’re building!

Daniel Yubi

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

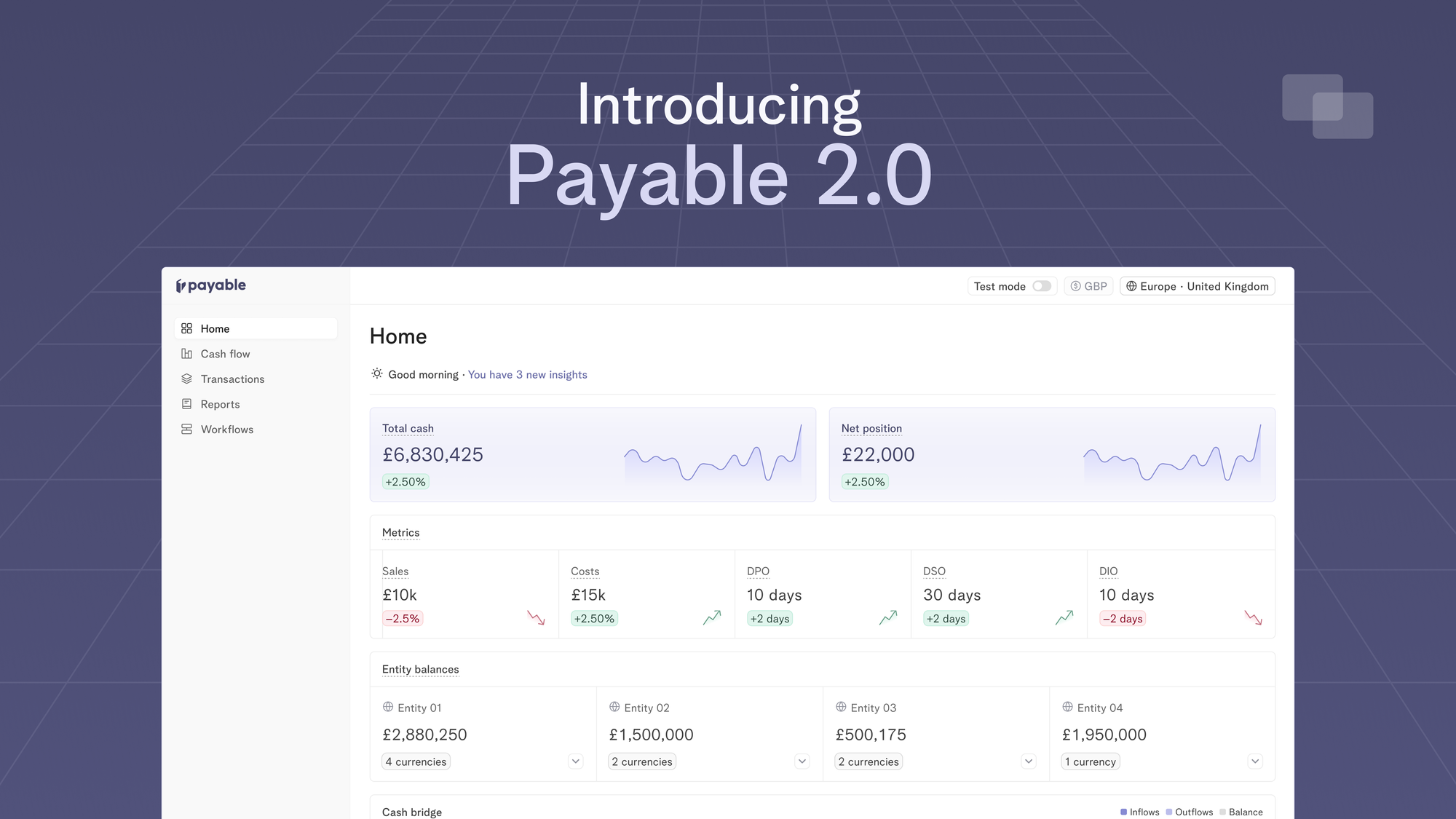

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.