Bank connectivity in treasury terms refers to the ability of an organisation to connect and interact with its banking partners. This can include accessing bank account balances and transaction data in real-time, plus initiating and tracking payouts.

Let's assume you found a fintech start up. You want to validate your idea quickly, starting with using a BaaS such as Modulr. This allows you to do bank transfers such as Faster Payments, BACs and CHAPs.

As you grow you find Modulr is expensive because you are using their EMI license to hold client money. Plus, you are also looking at expanding to Germany and the Nordics. The director of payments suggests it is best to get regulated there, so you press on and get a corporate account with Lloyds, JPM, Deutsche Bank and Danske.

As a company, you need to be able communicate directly with all of those banking partners. Whilst you scale, one of the key ways to do so is through their banking APIs.

What's an API?

An Application Programming Interface (API), is a service that allows two or more software programs to interact. Similar to a waiter, the waiter becomes a bridge between what you crave and what's available in the kitchen. Simply, APIs enable disconnected entities to communicate and exchange information with one another.

Let's say there is a new Buy-Now-Pay-Later service called Amarillo. Amarillo requests buyers to connect their bank account to their app, in order to underwrite the loan and validate their credit history. Chances are, Amarillo use a service like TrueLayer, which provides an API that enables the users' bank to securely share information with Amarillo.

Banking API use cases

- Lending: Using the same example from above, Amarillo has to pay out the merchant who sold the item to the buyer. Companies like Klarna, Koyo Loans, and other consumer lending companies offer small loans and without a banking API, Klarna would have to create a system to instruct payouts from their bank accounts, pull bank transactional data to track the repayments and reconcile that with their customer funds.

- Fintechs, PSPs, neobanks and stock trading apps: Payment companies and financial institutions require a financial infrastructure to build and launch new products for their customers. This is done by leveraging multiple bank partners through banking APIs.

- Marketplaces, delivery, ridesharing and payment facilitators: When users or businesses make payment through an app or in real life to pay for goods and services, it requires the company to make sure payments gets received in their bank account at the right time. If there is another party in the flow it will then require transferring a split of the funds on. Without a banking API, the company needs to securely build a way to facilitate transfers to and from their user's bank accounts in-house.

The benefits of a banking API

As you scale your operations it becomes unmanageable to login into multiple bank portals to manually track cash transactions and instruct bank transfers. This is time-consuming and prone to error, and if you are a regulated entity you will get fined for not properly reconciling client money. These are the benefits of having a banking API:

- Stop losing money: Connecting to your bank partners gives you access to your bank account balances and transaction data in real-time. That gives you the power to make better decisions, without investing resources in building in-house financial operations.

- Fast time-to-market: You can focus on building financial products, and the banking API abstracts away the complexity of dealing with bank files or SFTP connections, such as EBICs, MT or ISO 20022.

- Offer local currencies: In certain regions such as the Nordics, you need to work with a banking partner to offer local currencies which creates greater experience and choice for your users.

Don't build an internal bank API

Companies debate if they should hire or build software, but when the piece of software is separate from the core ROI of the business such as an abstraction layer between your banking partners and your customers then we recommend that you don't build this in-house. Beware of getting constrained by spreadsheets as you scale.

Bank connectivity solved ✅

Effective bank connectivity can provide numerous benefits for treasury management, including improved visibility into cash balances, streamlined transaction processing, enhanced fraud prevention, and better control over cash flow. By leveraging bank connectivity, payment teams and treasury managers can easily manage their cash positions, make informed financial decisions, and respond quickly to changes in cash needs or market conditions.

Organizations can improve their financial agility, reduce risk, plus achieve greater financial stability and success when using a great banking API and that supports their multiple bank partners.

All these things contribute to optimising your revenue.

Payable offers a fast go-live treasury dashboard and banking API modernising the treasury and payment function in scaling companies. Come and talk to us!

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

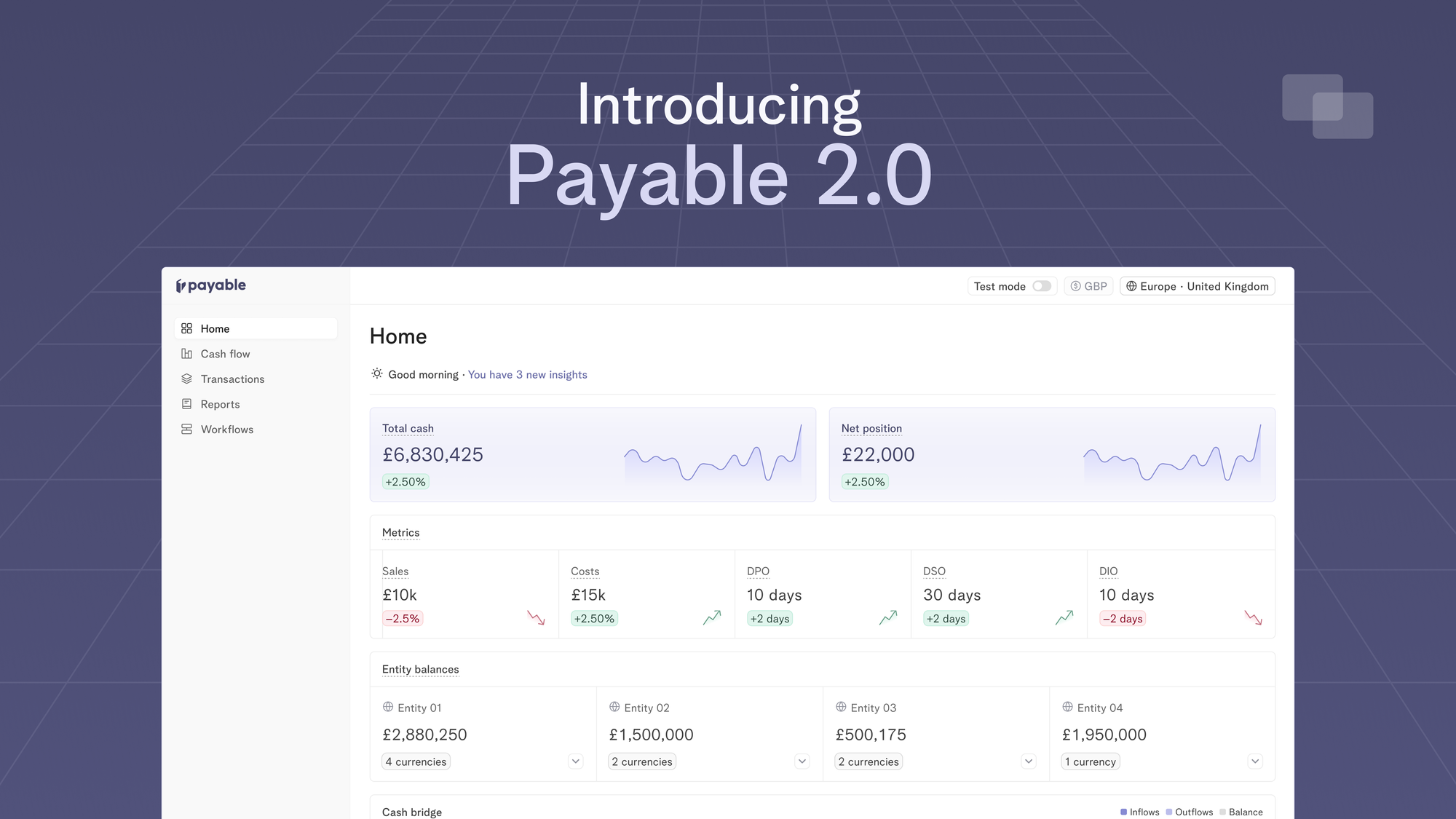

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.