We've raised $6.1M to build a payment operations platform so companies stop using EBICs, bank files and spreadsheets to move and reconcile money.

About a year ago, Raz and I sat down with the treasury and payment operations team at Checkout.com to understand what it would take us to launch the new marketplace solution.

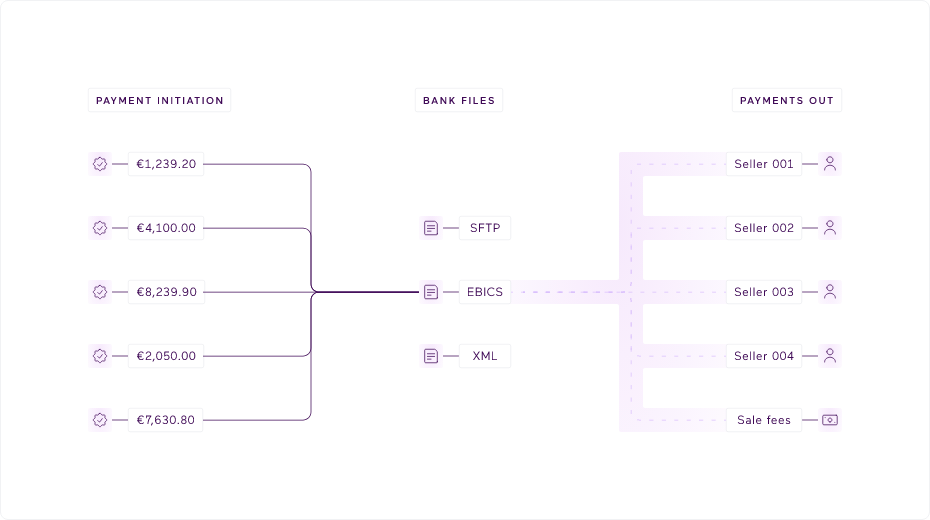

We realised that tech companies depend on clunky systems and outdated bank files to reconcile and make bank transfers. As companies scale, they get further into the payments value chain and become fintech companies. This causes nightmares for finance and operations teams, who have to manage new payment flows created by the product teams using typically manual processes.

Why we started Payable?

Today, companies move more than $4T of bank transfers in Europe alone.

For a healthy economy money needs to move efficiently between companies. Yet still in 2022 human intervention is required to download bank statements, reconcile payments, and initiate bank transfers. That's insane!

Raz and I left Checkout.com to solve this problem and build the one platform for payment operations for tech companies. Payable offers a Unified Banking API and a dashboard, which allows companies to connect their banks and wallets to automate payment reconciliation, and initiate bank payments, with a single API and a web app.

Our vision for Payable

In 1999, Salesforce was founded on a single, bold premise – that software should be made available to the masses, on a 24/7 basis, over a global cloud computing infrastructure. Before that companies built their own CRM and data centres to track each stage of the sales cycle and required resources from growing their core business.

I see a future where this will happen with payment operations software. Businesses who want to embed payments, fintech products and add unique payment flows, should have software that is useful to everyone in the organisation. Real-time data that brings clarity to a global financial infrastructure.

Our goal is for Payable to be the software that enables companies to bring their own corporate bank accounts, wallet provider or financial data source, so they can have one tool for initiating, tracking and reconciling payments.

Today, we reconcile 2 million transactions in less than 3 seconds, and we've connected with all the key banks across the UK and Europe. We're constantly expanding our coverage of payment providers and wallets. We've grown the team to 12 people, bringing experience from across the fintech scene, including Truelayer, Stripe and Freetrade.

Many thanks!

We are humbled to be backed by CRV and Earlybird, and with the participation of Conversion Capital, Clocktower Ventures and a set of great angel investors, including Nik (This Week in Fintech), Russel, Dan (Public), Hristo (Payhawk), Dileep (Jeeves), Paul and Eric (Bitpanda), Francesco (Truelayer), and many more.

Thank you to our early design partners, our early team, and every investor for the trust you have placed in us and the help along the way. If you want to run your payment operations with Payable, or you would like to join us or become a partner bank, contact us 🙌

Read more about our raise on EU Startups and TFN.

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.