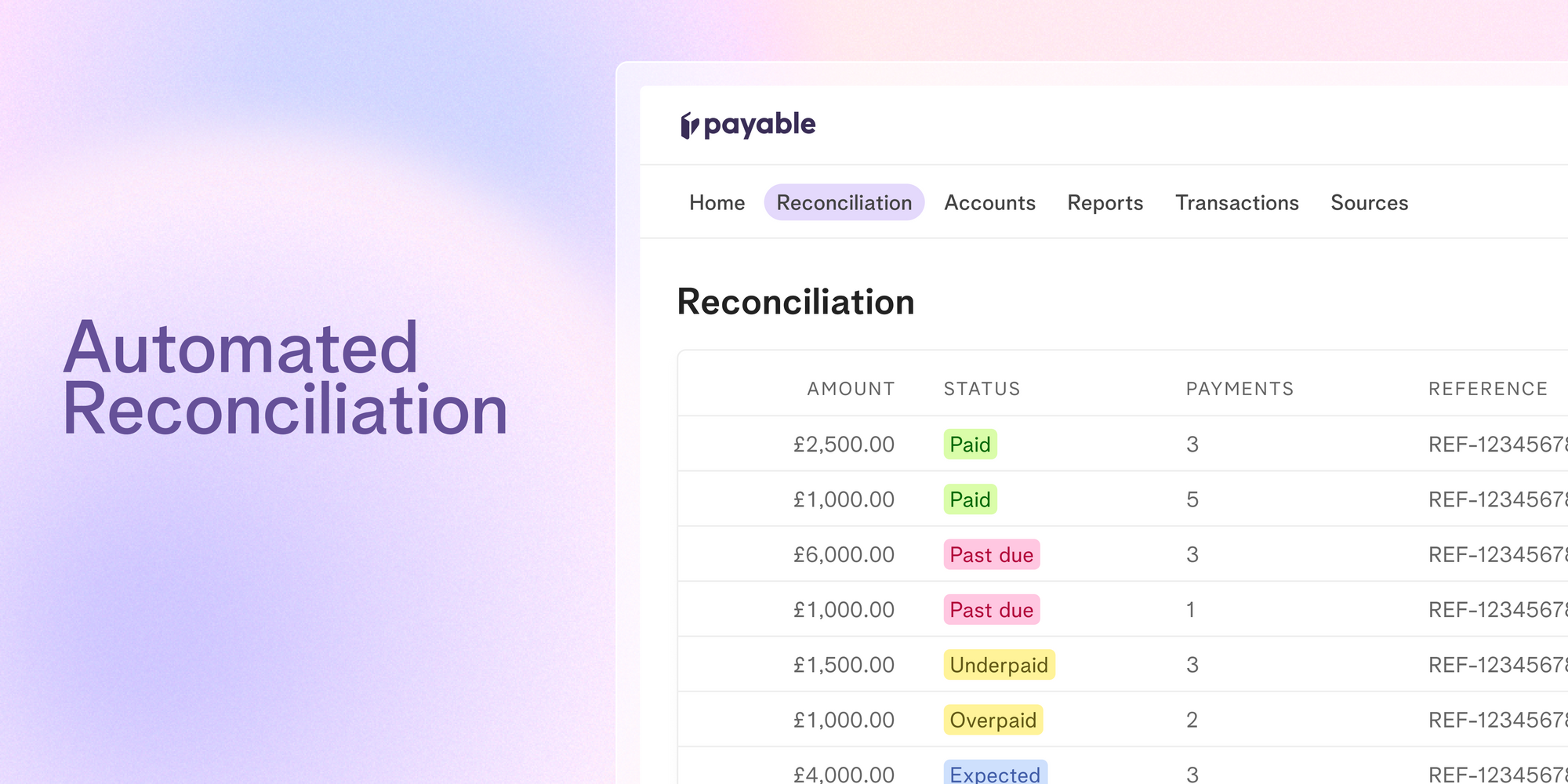

Bank reconciliation just got easier! Payable provides intelligent reconciliation for finance teams with automated matching, reporting and clever workflows for conflict resolution.

According to a PWC report, 30% of your finance team’s time is spent on manual reconciliation. Even amongst the top companies, analysts spend 40% of their time gathering data from fragmented sources rather than driving insights.

Now more than ever, each business' payments stack is expanding to accommodate new payment methods and support growth. Companies expand into new markets and diversify their banking relationships, which means more bank accounts and exponentially higher volume payments for finance teams to manage.

We believe that growth should not be held back by inefficient processes and spreadsheet constraints. That is why we built automated reconciliation - to help back office teams reduce time spent on manually matching payments and tracking invoices and instead accelerate their business growth.

Why is reconciliation so complicated?

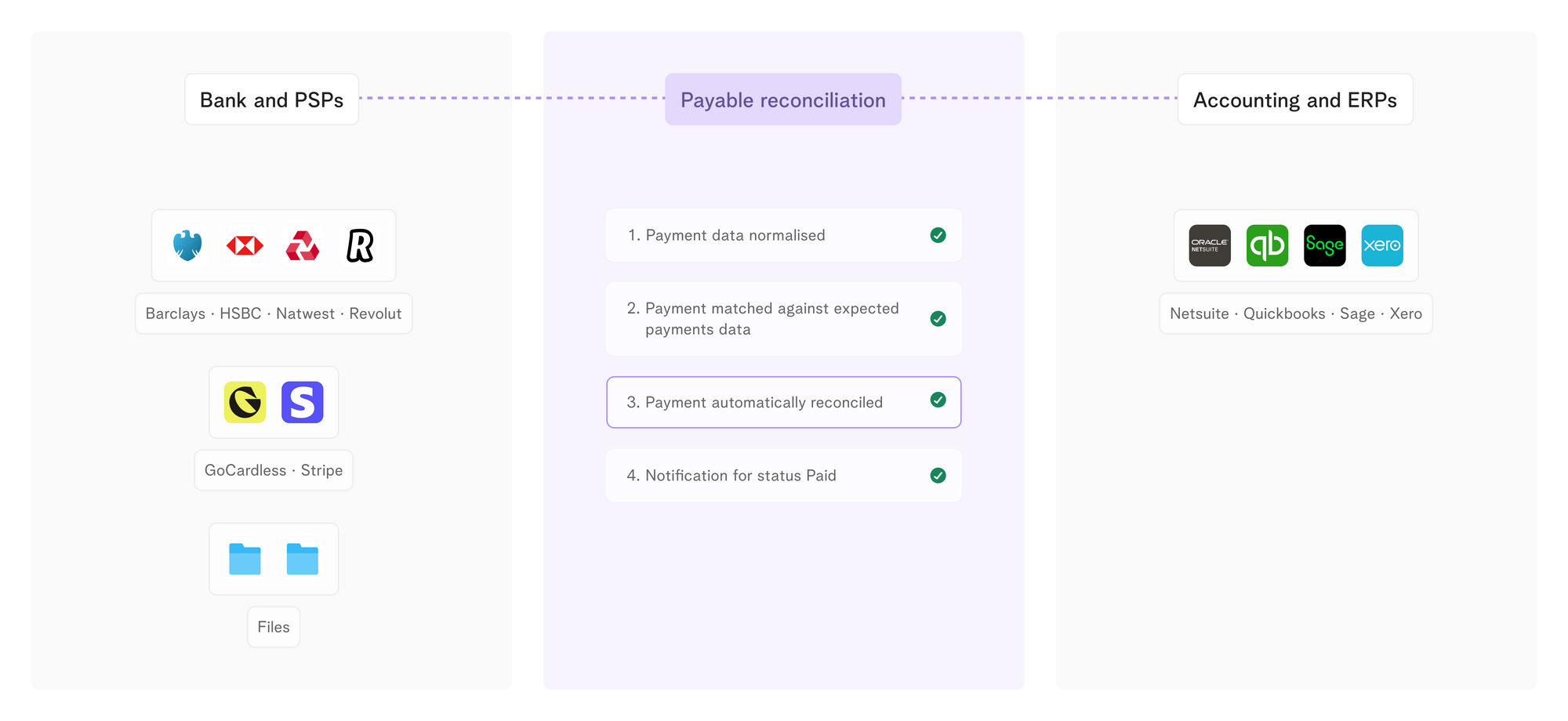

Reconciliation involves comparing and matching huge volumes of data of expected payments recorded in your internal database (or ledger) to the actual payments that are recorded in your bank balance or digital wallet. Due to the different sources that the transaction data is pulled from (bank portals, payment service providers, accounting software etc), it has widely different formats, structures, conventions or even missing information that need to be normalised before reconciliation matching can even start.

For example, some of your customers might be paying you in direct debit instalments while others send you money via bank transfer. Each payment method has its own format and structure which makes matching particularly difficult if the key data points (like references, amount, frequency, payee name) are inconsistent or missing. As a result, getting to a single source of truth each time your finance team performs reconciliation, can become an impossible and risky task. And without reconciliation, it’s hard to keep track of the cash available in your bank account to manage your business effectively.

Many businesses still perform manual reconciliation, which involves someone in the finance team logging into multiple banking portals, downloading transactions, aggregating them into spreadsheets and manually matching them with payments. Fully automating the reconciliation process is challenging. This difficulty compounds as the business grows and your payment and invoicing volumes increase. Very soon the spreadsheet your team used to rely on cannot match the scale and complexity of your corporate structure. You end up spending more time fixing formulas and stitching data from all your banks and payment methods than actually managing your company's finances.

Upgrade your bank reconciliation process with automation

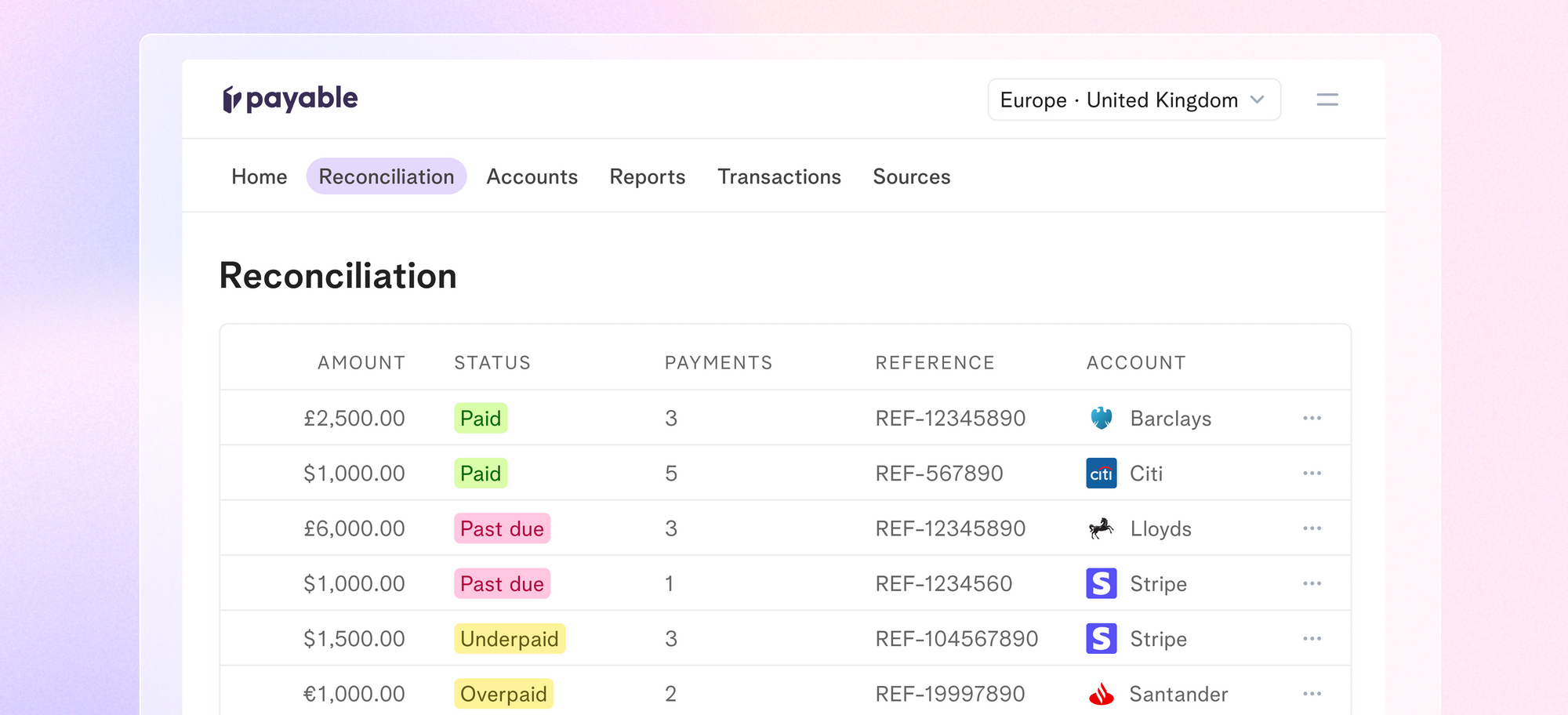

Payable streamlines your payment operations and automates reconciliation from start to end. We consolidate all your data sources (banks, file uploads, payment service providers) allowing you to understand what is owed and what has been paid at any given time, in real-time. We’ll tell you of any mis-matched payments so you can resolve them instantly. You will never have to log into your bank portal again!

Here’s how it works:

- We connect directly with over 2,000 banks and processors to pull all your transactions in real-time.

- Your data is automatically categorised and normalised to ensure the name and reference data is extracted as clearly as possible. Our intelligent reconciliation engine matches it against the information we pull from your accounting tool or ERP software, to make the most informed reconciliation decision.

- All reconciled transactions are automatically updated in your accounting and ERP tools. No more manual matching, lost payments and data stitching.

Alvaro Noriega, Head of Finance at Payflow says: “With Payable we have automated at least 40% of the manual work we were doing.”

Building the next generation of finance and treasury tools

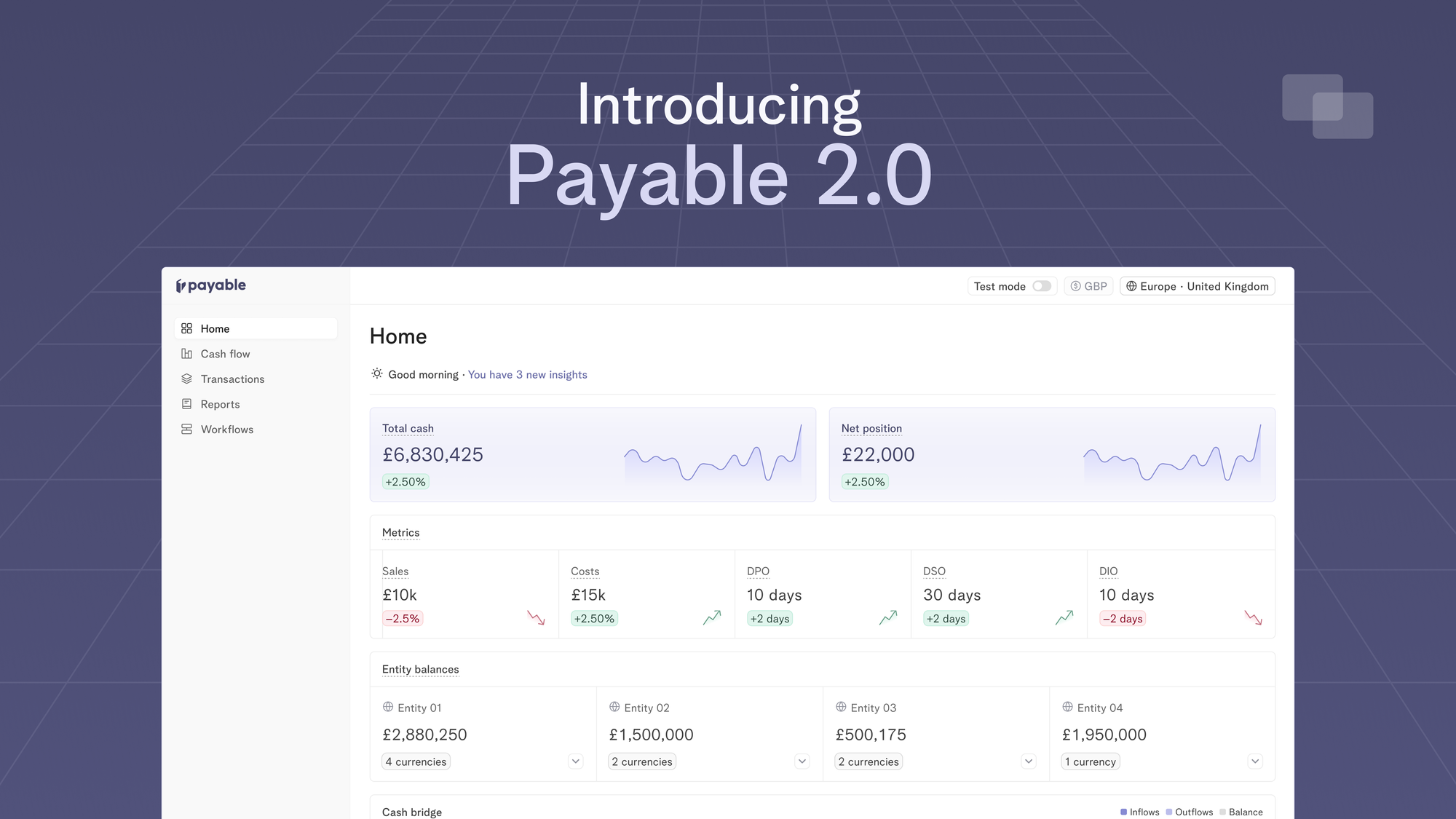

The future of finance and treasury tools is automation. What was once fragmented and siloed is now automated and centralised. Payable connects all your data into a single dashboard and automatically reconciles all your payments, increasing your financial data accuracy and reducing time spent on manual tasks.

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.