This is the second article in our Bank Connectivity Series. To understand what bank connectivity is and how different methods compare, visit our previous article.

In simple terms, host-to-host (H2H) connectivity allows seamless communication and data exchange between different software systems. It's like having a direct line between your company's system and your banking partners. For many businesses, H2H connectivity is the key to automating their treasury and financial operations. It allows to exchange financial data with banks in real time, making it easier to manage liquidity, monitor cash flows, and make informed financial decisions. All that helps your team save time on manual tasks and create financial processes that work well as your business scales.

In the past, H2H connectivity was mainly available to large enterprises. But thanks to advancements in technology and the rise of fintech solutions, H2H connectivity is now more accessible to smaller businesses. That means scale-ups, small and medium-sized enterprises, and even non-profit organisations can connect to their banks to optimise their financial operations.

Let’s dive into the details.

How does H2H connectivity work?

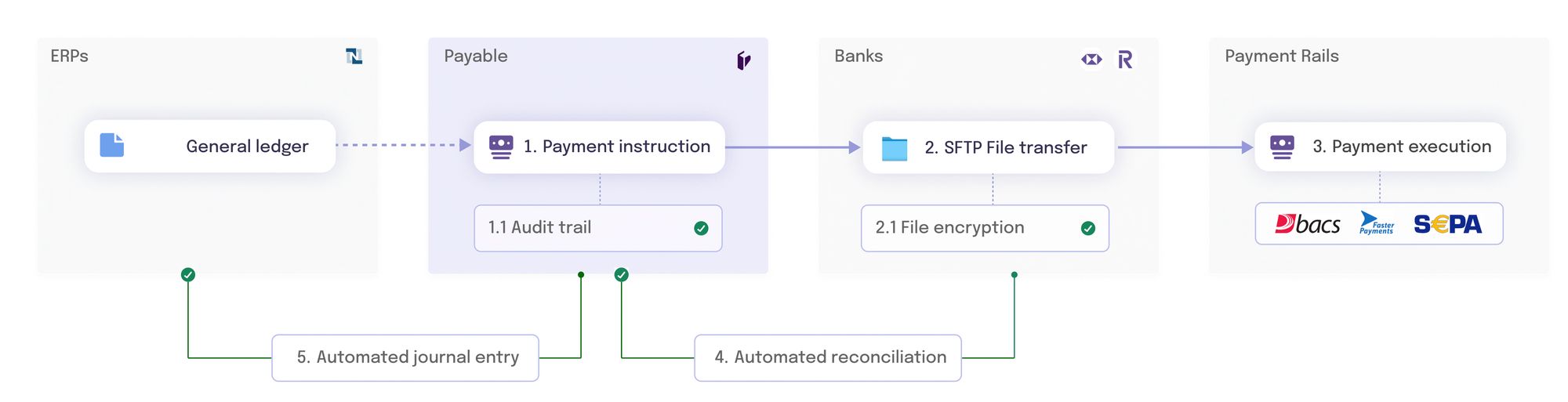

H2H connectivity operates on a secure channel, usually through electronic data interchange (EDI) or application programming interfaces (APIs). This secure connection makes sure that your sensitive financial information stays protected throughout the data transmission. With this direct link, you can automate various financial operations like payment initiation, cash management, and reconciliation.

Here is a step-by-step breakdown of how H2H connectivity works:

- System integration: Your company's financial systems, like your enterprise resource planning (ERP) software or treasury management systems, get integrated with your bank's systems. This integration can happen through different methods, like APIs, secure file transfer protocols (FTP/SFTP), or web services.

- Establishing connectivity: You create a secure and dedicated connection with your bank's systems. This connection can be through a virtual private network (VPN) or other secure channels to make sure your data stays confidential and intact.

- Data exchange: Once the connection is established, your financial systems can exchange various types of financial data with the bank, like payment instructions, account balances, transaction details, and account statements. The data can be transmitted in a standardised format, such as ISO20022 or SWIFT, making it easier for both sides to understand, or using a custom format developed by the bank.

- Authentication and security: Strong authentication mechanisms ensure the security of the communication. This includes things like digital certificates, secure login credentials, encryption, and other security measures to verify the identity of both your company and the bank.

- Transaction processing: Your financial systems generate payment instructions or other financial transactions, which are securely transmitted to the bank through the connection. The bank's systems receive and process these instructions, carrying out the requested transactions like fund transfers, direct debits, or foreign exchange transactions.

- Confirmation and reporting: After processing the transactions, the bank generates confirmation messages or reports that are sent back to your financial systems. These messages provide details about the transaction status, settlement information, and account balances. This helps you keep your financial records accurate and up to date.

What are the benefits of connecting to banks using H2H connectivity?

Direct bank connectivity

One great thing about H2H connectivity is that it can seamlessly integrate with different banking partners. Instead of dealing with multiple banking portals and interfaces, you can consolidate all your banking relationships. That does require an interface to simplify access the data and make it usable for different tasks finance and treasury teams would do - balance reporting, cash flow management or paying bills etc.

Cash visibility and management

Another significant advantage is improved cash visibility and liquidity management. By automating processes like cash pooling and sweeping, you can keep a close eye on your cash position across multiple accounts and locations. This visibility allows for better forecasting and optimisation of your liquidity, empowering you to make informed choices about investments, debt management, and working capital allocation. With H2H connectivity, finance teams can proactively manage their cash flows, reducing idle balances and maximising interest income.

Risk management

H2H connectivity is not just about making financial processes efficient. It also plays a crucial role in risk management. With direct connectivity, you can establish strong controls and security measures, reducing the risk of fraudulent activities and unauthorised access to sensitive financial information. Plus, it makes transaction data exchange smooth and easy, which helps with reconciliation. This cuts down on errors and helps you comply with regulatory requirements, ensuring transparency and accountability when scaling financial operations.

What are the challenges with H2H connectivity?

Long integration time

Despite its evident advantages, H2H connectivity does come with a few challenges. One of the main hurdles is implementation. Integrating with banks can be complex and time consuming. It requires collaboration between your finance team, IT department, and banking partners to make sure everything goes smoothly. That means endless meetings internally and with your banking partner. Once the connections are set up, you will still have to maintain them.

Costs

Bank integrations are not cheap. Depending on the bank, typically you will have to pay for a one-time implementation and monthly maintenance fees. Implementation costs vary from a few hundred pounds up to a few thousand. You might also be quoted different prices based on your use case - payments come at a high price while using H2H connections for reporting is usually much cheaper. Since there’s no publicly available price list you can try to negotiate.

How Payable simplifies data exchange with H2H connectivity?

Integrating with your bank is not easy, yet it's vital to help your business scale. We know that every bank operates differently, even with industry standards in place. Payable takes care of managing that complexity for you. No matter what file format or bank connectivity your bank supports, we've got you covered.

Our team handles the entire implementation process, so you don't have to worry about attending endless bank meetings or getting caught up in the details. We assess the best strategies to access data or execute payments tailored to your specific needs. Whether you need real-time updates or the most detailed data available, we've got your back. Once we have your requirements, we negotiate with the bank to finalise pricing and ensure robust security measures are in place. From there, we build your solution and conduct rigorous testing. And when it's time to go live, we work closely with you to ensure a smooth transition.

If you're looking to streamline your financial processes and take advantage of the benefits of H2H connectivity, Payable can help. Connect with over 2,000 banks and consolidate all your banking data into a single dashboard. It's time to simplify your financial operations and make smarter decisions.

Get in touch today and explore how Payable can help you.

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.