We are excited to introduce Payable Integrations - the essential connecting layer between bank transactions and finance tools. Payable Integrations save finance teams hours each day by connecting siloed banking portals, accounting tools and spreadsheets into one single dashboard for complete cash visibility.

Research shows that finance teams still spend up to 10 hours a week on manual tasks, alternating between separate systems, spreadsheets and banking portals. This wasted time could be better spent managing cash flow and collecting payments that are overdue or underpaid.

Unify financial tools for complete cash control

Payable Integrations connects all your invoices, bills and expenses with bank transactions and payments in real time. Our intelligent matching engine automatically allocates payments, reconciles invoices and keeps all your financial tools in sync.

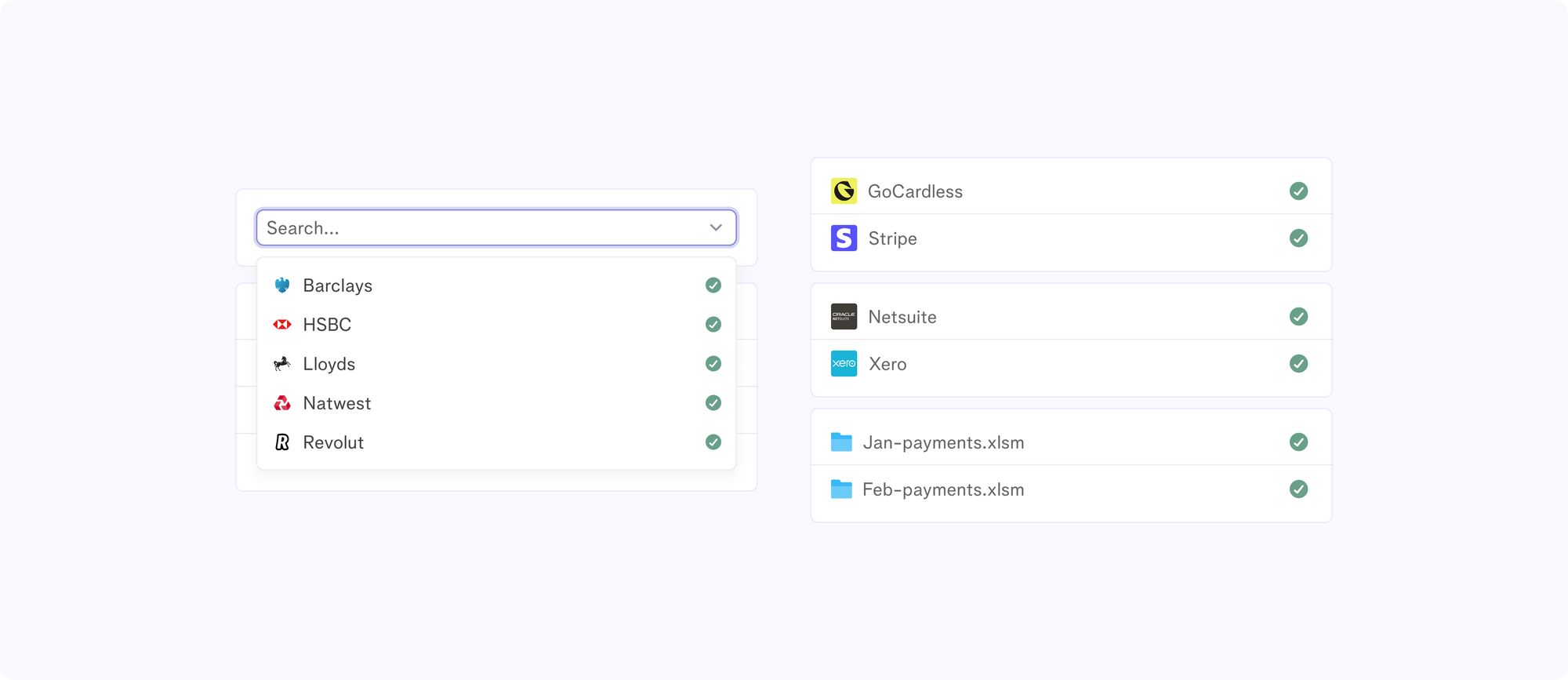

Bank and Payment Provider integrations

Aggregate live account balances and transactions from over 2,000 banks and payment providers in a single platform. Monitor your cash flow and money movement across all accounts, currencies or business entities giving real-time insights into your cash position. If you use an e-money solution or bank that’s not available through standard API integrations, we will work out the best way to pull transaction and balance data into the system.

ERPs and Accounting tools

Payable Integrations bring all your bill, invoice, vendor and customer data from leading ERP and accounting tools like Xero and NetSuite. Automate reconciliation from start to end and make your business tools work harder for you.

File sharing and spreadsheets

There are still a number of banks or payment providers that don’t have an integration option to pull through data in real time. Our file uploader means you can add data as it comes - whether it’s a spreadsheet or using file storage (EBICs, CSVs, or XML files or SFTP integrations). Payable Integrations connect any data source via the dashboard or the API to give you a single source of truth for all your cash and transaction data.

Why it’s useful:

- Save hours of manual data collection with a direct connection to your finance tools and banking partners.

- Accelerate your financial close with automated reconciliation connecting your invoice data with bank transactions.

- Eliminate the risk of human error by automating financial data entry and connecting it all in one place.

- Keep your accounting and ERP tools in sync with real-time updates from Payable when payments are automatically reconciled.

- Improve cash visibility with a single source of truth for all your cash movement.

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.